Mind the Data Gaps

Now that it is fall and we have all realized some type of new normal, I want to go back to our blog series on the importance of data quality for unions, funds and administrators. Now, more than ever, our new, often virtual environment has a dependency on accurate, current data. I have been gradually tackling each item in MIDIOR’s 10 step data quality program and will address the fifth in this post. It has been a while, so here is a reminder of those details:

- You know where your data comes from in terms of systems and sources

- You are aware of conflicts and inconsistencies between your data sources

- You have an approach for resolving any conflicts between data sources

- You capture data once, and use it in multiple places

- You have documented what data is critical for implementing your business rules, and you have approaches for filling in any missing data

- You have tools and processes for identifying and correcting flaws in your data

- Your data exists in a format that makes it easy to access using readily available tools

- You are not dependent on a software vendor for access to your data

- Everyone on your team is cognizant of the value of “good data” and the long-term costs of "sloppy data”

- You leverage your data to support operations AND to support long term decisions

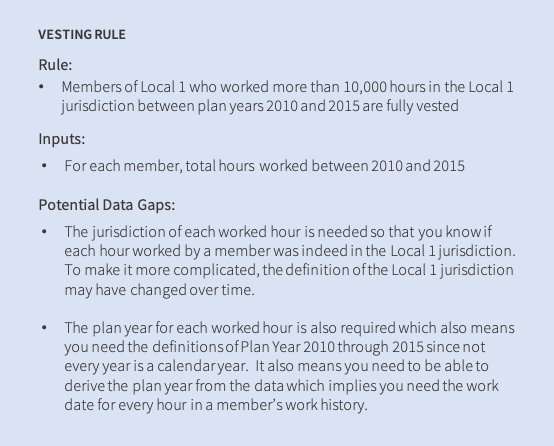

In the last two posts, I talked about the importance of establishing a “system of record” for each piece of data and a commitment to capturing data once and only once (even though it is likely to be used in multiple places). Following on from there, now that you know what data you have, how you get it and where it lives, you can easily figure out what you don’t have but do need. In other words, where are your data gaps that could mess with the accuracy of your systems? In the context of funds and administrators, the data gaps are usually related to information needed to completely implement your business rules. These could be rules related to eligibility, contribution rates, benefit calculations, or maybe something as simple as who gets the monthly newsletter. If you don’t have any gaps, you (or your technical staff) will have a much easier time implementing the rules. In the context of a fund office, the data gaps are usually related to information needed to completely implement your business rules.

In order to determine if you have any gaps, start by defining all of the data inputs required to calculate a benefit, issue a disbursement, report on an activity or whatever else you may need to do according to the plan rules. Some of the rules are described in a plan’s SPDs and some are operational rules that have evolved over time and have become standard practice. In any case, we like to think of those business rules as a set of algorithms or equations, with defined inputs (data) and outputs (actions). If (and that’s a big if), you have clearly defined the algorithms to match your rules, then you can list all your required inputs and compare them to what you have available and define all of the gaps. Because systems are not people (who can often fill in the data gaps), you will need to figure out how to fill in all of the missing data and organize it in a way that lets you perform any calculation, and repeat it over and over, before you can consider your data set complete. The key point is to step through each business rule and ask yourself what piece of information is needed to complete that step and write that all down. I've included two simple examples below.